“A crucial rule of debt repayments is: clear the most expensive debts first,” suggests Martin Lewis, founder of.

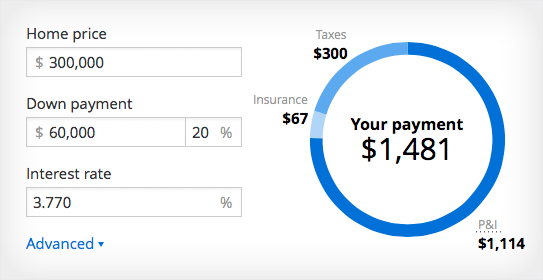

You might find that the payment is twice or three times your current mortgage. It will be much higher than your current payments. That’s the monthly payment you need to make if you want to pay off your home mortgage of $200,000 at 5 percent over five years.”įrankle says that, “The same mortgage paid off over 30 years is only $1,073 a month, so be prepared when you do this calculation. In Excel, the formula is PMT (interest rate/number of payments per year, total number of payments, outstanding balance). Let’s say your outstanding balance is $200,000, your interest rate is 5 percent and you want to pay off the balance in 60 payments – five years. If you do it yourself, you can use the following formula in Excel: Once you have that number, you’ll need to calculate what the payments will be to pay off the mortgage in five years,” says Neal Frankle on the Wealth Pilgrim.įrankle continues, “You can either ask the mortgage company to do the math, or you can do it yourself. You’ll need the current outstanding balance. “Call your mortgage holder or look at the latest statement. You could save that extra cash each month and put it towards your overall mortgage payment. If you plan on staying in your home for the foreseeable future, it may be worth paying for these points since you’ll end-up saving money on the interest rate of your mortgage. Origination fee: charged by the lender to cover the costs of making the loan.”.Discount: prepaid interest on the mortgage the more you pay, the lower the interest rate.McElheny adds, “there are two kinds of points, discount and origination fees: Stephanie McElheny, the Assistant Director of Financial Planning at Hefren-Tillotson in Pittsburgh, says that “one point is equal to 1 percent of the loan amount (ex. Whenever people are curious about how much their mortgages cost are going to cost them, lenders will provide them with quotes that include loan rates and points. “ It ended up being much less than what the bank told me I could afford.” 2.

I examined my monthly budget and determined what I wanted to spend on housing,” Timmerman adds. Some people use this number to set a housing budget, but not me.”

“The bank will look at your overall financial picture and spit out an amount that you’re likely to get a loan for. “If you want to finance a home, you’ll need to get prequalified first,” writes Mike Timmerman, who paid off his mortgage in just two years.

0 kommentar(er)

0 kommentar(er)